COLA 2023: 8.7% Benefit Increase

Author: United States Social Security Administration

Published: 2022/10/13 - Updated: 2022/10/15

Peer Reviewed Publication: Yes

Category Topic: U.S. Social Security - Related Publications

Page Content: Synopsis - Introduction - Main

Synopsis: 8.7 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 65 million Social Security beneficiaries in January 2023. Medicare premiums are going down, and Social Security benefits are going up in 2023, which will give seniors more peace of mind and breathing room.

- Definition: COLA (Social Security)

Since 1975, U.S. Social Security's general benefit increases have been based on increases in the cost of living, as measured by the Consumer Price Index. Such increases are called Cost-Of-Living Adjustments, or COLAs. A cost-of-living adjustment (COLA) is an increase made to Social Security and Supplemental Security Income (SSI) to counteract the effects of rising economic prices, known as inflation. Inflation is measured using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Introduction

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase by 8.7 percent in 2023, the Social Security Administration announced today. On average, Social Security benefits will increase by more than $140 per month starting in January.

Main Content

The 8.7 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 65 million Social Security beneficiaries in January 2023. Increased payments to more than 7 million SSI beneficiaries will begin on December 30, 2022. (Note: some people receive both Social Security and SSI benefits). The Social Security Act ties the annual COLA to the increase in the Consumer Price Index as determined by the Department of Labor's Bureau of Labor Statistics.

"Medicare premiums are going down, and Social Security benefits are going up in 2023, which will give seniors more peace of mind and breathing room. This year's substantial Social Security cost-of-living adjustment is the first time in over a decade that Medicare premiums are not rising. It shows that we can provide more support to older Americans who count on the benefits they have earned," Acting Commissioner Kilolo Kijakazi said.

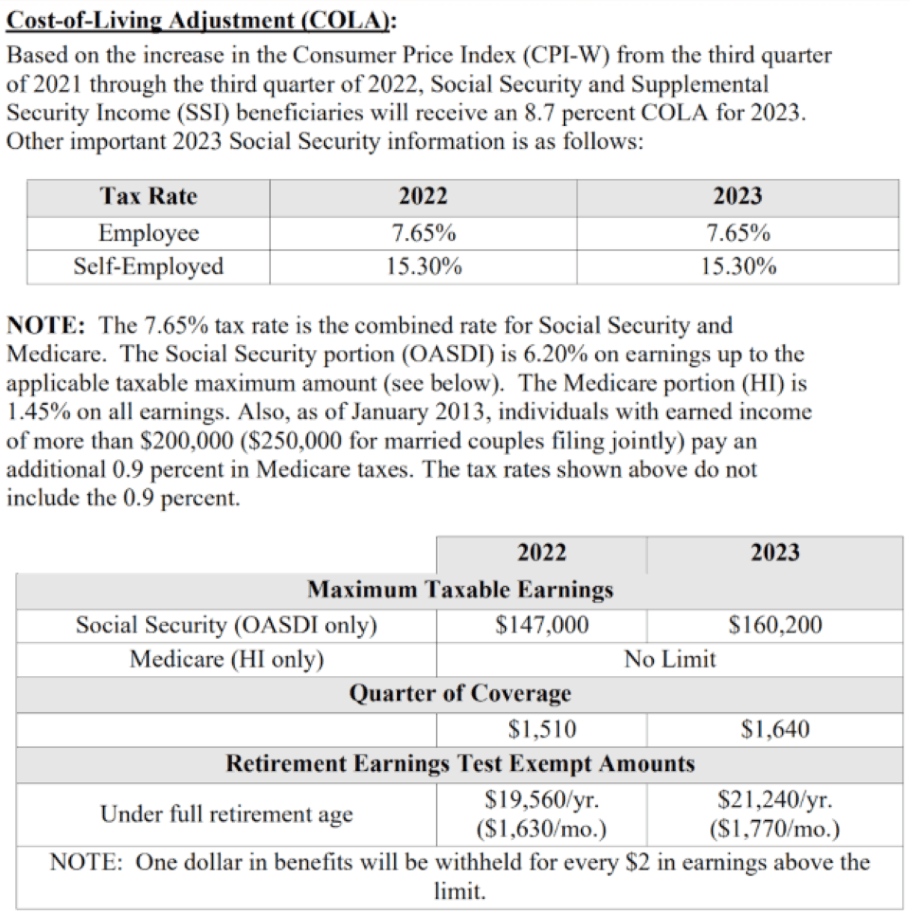

Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $160,200 from $147,000.

Social Security and SSI beneficiaries are normally notified by mail starting in early December about their new benefit amount. The fastest way to find their new benefit amount is to access their personal my Social Security account to view the COLA notice online. It's secure and easy, and people find out before the mail arrives. People can also receive a text or email alert when a new message from Social Security - such as their COLA notice - is waiting for them, rather than receiving a letter in the mail.

For Social Security beneficiaries enrolled in Medicare, their new higher 2023 benefit amount will be available in December through the mailed COLA notice and my Social Security's Message Center.

Record of Yearly COLA Percentages Since Inception

| Social Security Cost-Of-Living Adjustments Since 1975 | |

|---|---|

| Year | COLA |

| 1975 | 8.0 |

| 1976 | 6.4 |

| 1977 | 5.9 |

| 1978 | 6.5 |

| 1979 | 9.9 |

| 1980 | 14.3 |

| 1981 | 11.2 |

| 1982 | 7.4 |

| 1983 | 3.5 |

| 1984 | 3.5 |

| 1985 | 3.1 |

| 1986 | 1.3 |

| 1987 | 4.2 |

| 1988 | 4.0 |

| 1989 | 4.7 |

| 1990 | 5.4 |

| 1991 | 3.7 |

| 1992 | 3.0 |

| 1993 | 2.6 |

| 1994 | 2.8 |

| 1995 | 2.6 |

| 1996 | 2.9 |

| 1997 | 2.1 |

| 1998 | 1.3 |

| 1999 | 2.5 |

| 2000 | 3.5 |

| 2001 | 2.6 |

| 2002 | 1.4 |

| 2003 | 2.1 |

| 2004 | 2.7 |

| 2005 | 4.1 |

| 2006 | 3.3 |

| 2007 | 2.3 |

| 2008 | 5.8 |

| 2009 | 0.0 |

| 2010 | 0.0 |

| 2011 | 3.6 |

| 2012 | 1.7 |

| 2013 | 1.5 |

| 2014 | 1.7 |

| 2015 | 0.0 |

| 2016 | 0.3 |

| 2017 | 2.0 |

| 2018 | 2.8 |

| 2019 | 1.6 |

| 2020 | 1.3 |

| 2021 | 5.9 |

| 2022 | 8.7 |

- People may create or access their my Social Security account online at www.ssa.gov/myaccount

- Information about Medicare changes for 2023 is available at www.medicare.gov

- The Social Security Act defines how the COLA is calculated. To read more, please visit www.ssa.gov/cola

- To view a COLA message from Acting Commissioner Kijakazi, please visit www.youtube.com/watch?v=Vgm5q4YT1AM

Attribution/Source(s): This peer reviewed publication was selected for publishing by the editors of Disabled World (DW) due to its relevance to the disability community. Originally authored by United States Social Security Administration and published on 2022/10/13, this content may have been edited for style, clarity, or brevity.